[ad_1]

Investing in stocks inevitably means buying some underperforming companies.long Highlight Event and Entertainment Co., Ltd. (VTX: HLEE) shareholders know this because the share price has fallen dramatically over the past three years. So at the time they were probably emotional about the 61% plunge in the stock price. The most recent news has been troubling, with shares down 46% in a year. Things have been tougher for shareholders lately, with shares down 13% over the past 90 days.

With shareholders on the downside for a long time, let’s look at the fundamentals at the time to see if they are consistent with returns.

Check out our latest analysis for highlight events and entertainment

With Highlight Event and Entertainment posting losses over the past 12 months, we think the market may be more focused on revenue and revenue growth, at least for now. Generally, companies with no profits are expected to grow revenue each year, and at a rapid rate. Some companies are willing to defer earnings to grow revenue faster, but in this case, one does expect good revenue growth.

For more than three years, Highlight Event and Entertainment’s revenue has grown at an annual rate of 4.9%. Given that it’s losing money in its pursuit of growth, we’re not entirely happy with that. This lackluster revenue growth certainly helped drive the stock lower; it’s down 17% over the period. When a stock falls sharply like this, some investors like to add the company to their watch list (in case the business recovers, long-term). Remember, it’s not uncommon for good businesses to have tough times or have a few uninspiring years.

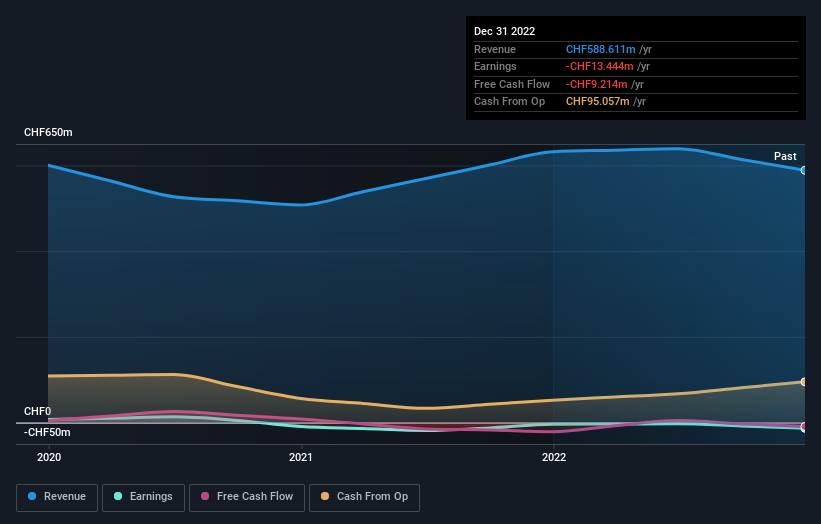

The company’s revenue and earnings (over time) are shown in the graph below (click to see exact figures).

The strength of the balance sheet is crucial.Might be worth checking out our free Report how their financial situation has changed over time.

Different perspectives

Shareholders of Highlight Event and Entertainment are down 46% this year, but the market itself is up 1.8%. Even good stocks can drop in price at times, but we want to see an improvement in the fundamental metrics of a business before becoming too interested. Sadly, last year’s results ended a poor run, with shareholders facing gross losses of 7% per year over five years. We realize that Baron Rothschild has said that investors should “buy when there is blood in the streets”, but we remind investors to first ensure that they are buying high-quality businesses. I find it very interesting to look at long-term stock prices as a proxy for business performance. But to really gain insight, we need to consider other information as well.For example, we found 2 Warning Signs for Important Events and Recreation You should know this before investing here.

But please note: Highlight Event and Entertainment Might Not Be the Best Stock. so look at this free A list of interesting companies with past earnings growth (and further growth forecasts).

Note that the market returns quoted in this article reflect the market-weighted average return of stocks currently traded on the Swiss Exchange.

Have feedback on this article? Concerned about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only an unbiased methodology to provide reviews based on historical data and analyst forecasts, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no positions in any of the stocks mentioned.

Join Paid User Research Sessions

you will receive a $30 Amazon Gift Card Take 1 hour of your time while helping us build better investing tools for individual investors like you. register here

[ad_2]

Source link