[ad_1]

With higher demand related to travel and leisure expected in 2023, entertainment companies and theme parks continue their post-pandemic recovery.

The leisure and entertainment services sector is currently in the top 24% of the 250 plus Zacks Industries, and here are two stocks investors should consider buying right now.

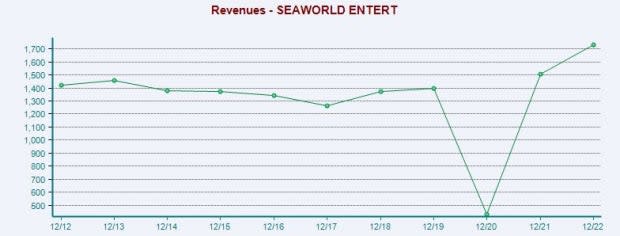

Sea World Entertainment (sea area)

SeaWorld Entertainment stock, which carries a Zacks Rank #2 (Buy), is starting to come out on top as the owner and operator of the popular SeaWorld, Busch Gardens and Sesame Place brands.

Related to the expected increase in demand for leisure and entertainment services, earnings estimate revisions for SeaWorld stock started to rise after the company beat its top- and bottom-line fourth-quarter estimates last Tuesday.

Image Credit: Zacks Investment Research

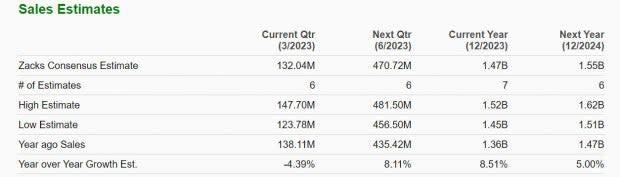

SeaWorld’s earnings are now expected to grow 20% in FY 2023 and another 7% in FY 24, to $5.32 per share. Sales are expected to rise 3% this year and another 2% in FY24 to $1.84 billion. Even more impressive, fiscal 2024 sales will be up 32% from pre-pandemic levels, reaching $1.39 billion in 2019 sales.

Image Credit: Zacks Investment Research

Shares of SeaWorld are now up 19% so far this year, matching the outperformance of the leisure and entertainment services market and largely outperforming the S&P 500 by 5%. Additionally, SeaWorld’s valuation suggests its outperformance in 2023 may continue.

Image Credit: Zacks Investment Research

SeaWorld stock trades at $63 per share and trades at 13.3 times forward earnings, well below its industry average of 23.2 and the S&P 500 average of 18.2. Moreover, SEAS stock is still trading 83% below its ten-year high of 82.4 times and 40% below its median price of 22.1 times. SeaWorld stock overall has an “A” VGM Style Score grade for its combination of Value, Growth and Momentum.

Six Flags Entertainment (six)

Another Zacks leisure and entertainment services stock investors should consider is Six Flags Entertainment, Inc., which currently carries a Zacks Rank #1 (Strong Buy). Six Flags stock also has an overall “A” VGM Style Score grade, and earnings estimate revisions are interesting for the regional theme park operator.

Known for its roller coasters, Six Flags also offers water attractions, concerts, and shows, as well as restaurants, gaming venues, and retail stores.

Image Credit: Zacks Investment Research

Six Flags raised its fourth-quarter earnings forecast by 39% on Thursday, and earnings expectations have risen despite a slight drop in revenue. FY2023 earnings are now expected to jump 27% this year and climb another 18% in FY24 to $2.42 per share.

Sales are expected to grow 8% in FY23 and another 5% in FY24 to $1.55 billion. What’s more, fiscal 2024 will be 5% above 2019 levels as Six Flags looks to continue its post-pandemic recovery.

Image Credit: Zacks Investment Research

Six Flags stock is up 25% year to date, outperforming the leisure and entertainment services market and benchmarks. Additionally, Six Flags’ P/E valuation also suggests that this strong performance is likely to continue.

SIX trades at around $29 and trades at 15.3 times forward earnings, which is below the industry average and benchmark. Even better, shares of Six Flags are trading 87% below their ten-year high of 118.9 times and 46% below their median of 28.3 times.

Image Credit: Zacks Investment Research

take away

Better-than-expected fourth-quarter reports from SeaWorld and Six Flags helped reaffirm that theme park demand for entertainment should continue to move higher. Rising earnings estimate revisions and attractive price-to-earnings valuations are reasons to believe SeaWorld and Six Flags shares could continue to rise.

Want the latest advice from Zacks Investment Research? Today you can download the 7 best stocks for the next 30 days. Click to get this free report

Six Flags Entertainment Corporation NEW (VI): Free Stock Analysis Report

SeaWorld Entertainment, Inc. (SEAS) : Free Stock Analysis Report

[ad_2]

Source link