[ad_1]

Christian Petersen/Getty Images News

Dear readers/followers,

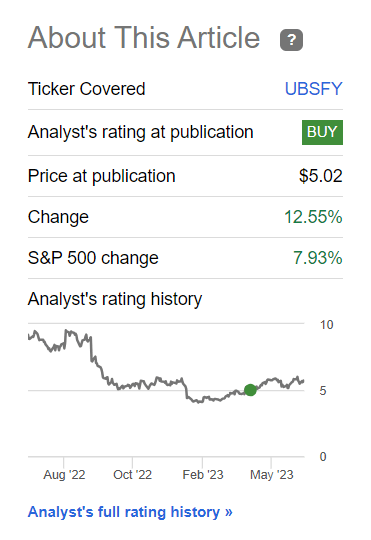

Ubisoft (OTCPK:UBSFF) isn’t my favorite gaming company — I happen to be a gamer — but it’s one to at least keep an eye on.In fact, in my most recent article, I was bullish and “long” The company is undervalued. Since then, the position has outperformed and we can now report double digit gains in less than 3 months – a very good overall trade from an investment standpoint.

The company faces many challenges.I don’t expect a quick recovery, not even in the next 1-2 years, but I do expect the company to slim down and turn the tide, based on strong brands in its portfolio and demonstrating that when companies pay attention, they It is actually possible to make some very great product.

Finding Alpha Ubisoft RoR (Finding Alpha)

Ubisoft – A lot of people love a good game

As I mentioned before, it’s not fair to call Ubisoft a terrible company. This is a gaming company that’s been through trouble — even fundamental trouble — but to say they no longer have an attractive portfolio or an attractive set of assets is just plain wrong. There’s a lot to like about Ubisoft — and a more attractive valuation than peers like Activision Blizzard (Activision Vision) is one of them.

There are so many signs that Ubisoft might actually be turning things around, if they just get a few “ducks” in a row. The company’s customers and players, myself included, are waiting for another great game from the company. For me, that includes things like Far Cry 5, which I consider to be one of the strongest games in the entire franchise.

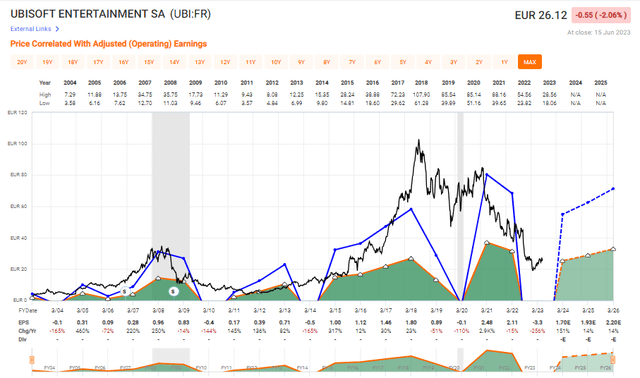

However, the real appeal I see comes from articulating exactly how far the company has fallen. Ubisoft is currently trading at less than 26.5 euros per share in its native Paris ticker. While this is up from prior levels and double digits, let me be clear that the stock’s implied Inclusive valuation points to an average PT or value well over 40 EUR/share. You can then go ahead and discount/undercut that valuation as you see fit – there are many reasons to do this.

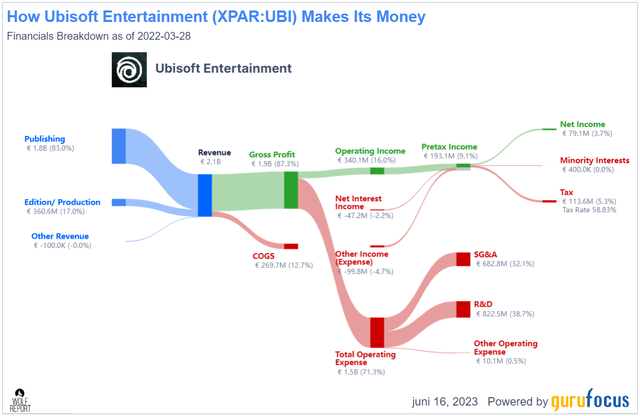

But there comes a point where you over-damage things — especially when we’re talking about a company that manages the best gross margins in the entire industry. Its current profitability problems are severe, but I think those trends may eventually reverse.

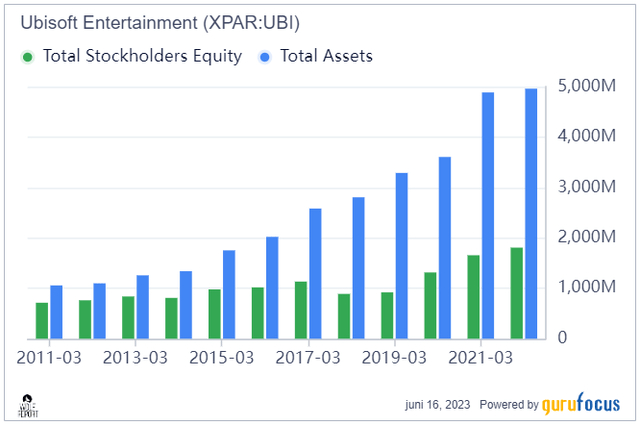

Ubisoft Revenue/Net (GuruFocus)

Also, it’s worth mentioning that despite all of these public issues, the company is still very profitable — just not as profitable as we’d like to see. It is true that debt has been rising and is now higher than ever. But at the same time, the company’s ROIC is very positive. The shareholder’s equity portion of assets has indeed fallen from over 60% in 2011 to less than 50% currently. None of these developments are positive, even if some of them can be explained by accounting and some temporary issues rather than longer-term issues.

The company reported less full-year earnings for fiscal 2023 than a year ago. Whenever they start their speech with “The past year has been challenging…” you can assume that things are indeed going to be greatly impacted.

In the meantime, Ubisoft is reporting progress on several fronts. Let’s see what’s in here.

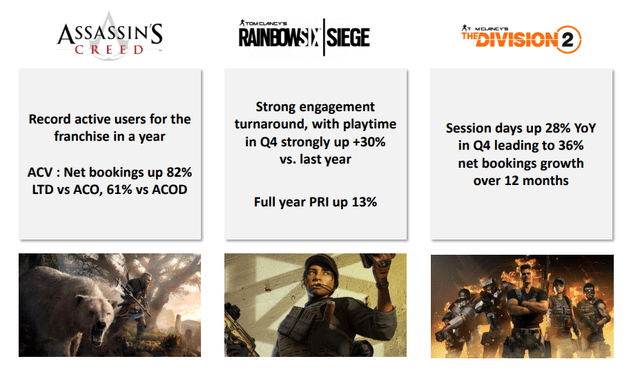

The top-line result, bookings, was down 18% to around €1.8B, just below that. Digital revenue was down 11% and trailing catalog revenue was down 30%. Meanwhile, some of the strongest franchises are having solid years in terms of activity and bookings.

Unfortunately, with the exception of Assassin’s Creed, most of these games and franchises have been somewhat lackluster. The Division 2, in particular, is not only starting to age, but its player count is also dropping significantly.

The company also hasn’t actually launched an import from Far Cry or any of the other franchises this year. Using a constant cost basis, excluding all profit bonuses but including P&L structure costs, the company’s costs are EUR 1.75B. While that’s lower than expected, it certainly falls short of the cuts we need to see from the company — even with millions of dollars saved through tighter hiring and favorable foreign exchange.

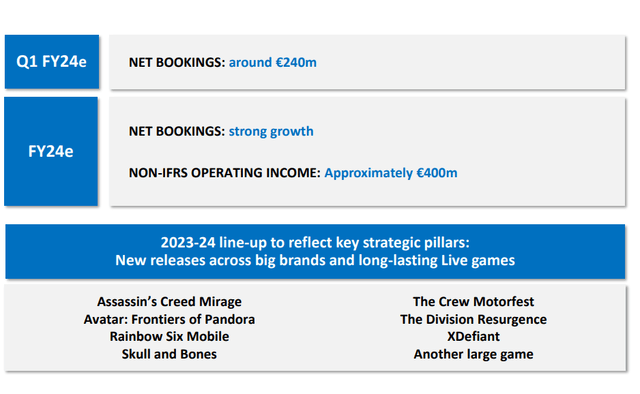

Headcount is down by 700, which is good, but at the same time, structural costs are up and cash R&D spending is still growing. As such, the company doesn’t yet have full control over all of its spending trends. On the other hand, the estimates for the future are positive, with the company expecting strong bookings growth, strong operating income growth, and eventual new launches in some of its core franchises.

As a gamer, I have zero interest in mobile gaming, although I certainly recognize the earning potential of such models and games.

Ubisoft still has long-term turnaround potential, and while the gaming industry is notoriously fickle, the only valuation I’d say you’d want to buy into any of these businesses is Clear discount. If you do it “right” then I believe your chances of making a profit are pretty good.

Ubisoft has added this complexity, as I’ve seen it, to games that don’t really excite me personally, as I have with their previous titles – such as AC: Valhalla.

The financial concerns are there. Net bookings growth deteriorated sequentially, which also included lower acceptance of mobile licenses. The company’s response to this was that it was just a case of how those revenues were recognized — namely, in the first three quarters of the last fiscal year. Ragnarok, Dawn of the Gods and a few other titles also saw year-over-year growth — but the dip and slowdown in growth was really noticeable, and if that continues, it’s something to watch. In short, Ubisoft must continue to bring products to market with fewer team leads and less R&D spending.

The second question, and the specific product of this question – Skull and Bones. The game has been in development for several years, and every release or preview I’ve seen has been worse or less promising than the last. Now it seems to me that the game was actually delayed internally due to some serious issues that I think the company thought the game might “fail”. I want to state for the record here that I don’t believe what the company tells us, and I don’t believe this game will appeal to players – but we’ll see here.

Working capital outflow is bad – I don’t see any clear catalyst for improvement other than the management and savings plans the company is already working on.The worrying part here is that the WC sucks No major releases in 2023 though. This is very atypical for a game company.

All in all, 2023 wasn’t impressive – I strongly believe 2024 could be even better.

Ubisoft – A Better 2024 is expected, here is the valuation of the paper

When I last wrote about Ubisoft, I described it as a “speculative” company. That rating holds even after outperforming the market’s double-digit RoR in the same time frame in April. From this perspective, the investment was a “success”.

What we’d like to see from Ubisoft is tighter capital controls and better working capital, new game releases, and, quite frankly, the company is just making some “better games.” At the same time, such goals are hampered by the fact that companies really slim down, and when a company goes through the kind of journey Ubisoft did, talent and leaders are often the first to leave — because they usually Better, more productive work can be found elsewhere, further disrupting the organization and hindering the end result.

Meanwhile, Ubisoft cheap. Very cheap.

On a 5-year basis, the company trades at an average of 3.1 times sales. Today that number is 1.5 times, which is our impacted sales number. With negative 2023A earnings, the local ticker trades at an unviable P/E, but is expected to turn positive again next year. The company’s past few years have been marked by prosperity, and we shouldn’t expect that to repeat itself, especially with the way the company is now developing.

As you can see above, Ubisoft can only guarantee a “speculative” rating. I am positive on this case because I have a better understanding of the ups and downs of these companies than most investors and analysts.Ubisoft will rise. I have no doubts about it. The question is how much, how high and for how long, it will depend on their commercial success in 2024-2025. As I see it now, the company doesn’t have much exciting things to do in the short term, which is why I’m not targeting my PT above €45, but a conservative long term €40/share PT.

I also did not adjust this target due to the full year performance. Why? Because the assumptions I’m using already include this relatively poor 2023A potential, especially in terms of cash flow. Working capital was a bit of a surprise and it was negative.

The company’s troubles run deep. But it’s during times like this that bargains can be made – like most gaming companies, a large part of the company’s expenses are HR/directors – and for these types of companies, those expenses are somewhat variable, which is what companies are doing now cutting.

Ubisoft needs a revival at the corporate level. I haven’t seen this happen yet. But in the long run, I’m bullish on this company and expect it to do well.

Based on that, here’s my thesis for the company.

paper

- On paper at least, Ubisoft is an attractive company with good upside at the right price. However, due to mismanagement in my opinion, the company’s intellectual property and pipeline doesn’t really have many products or games that I think could reverse the current unfavorable trend.

- We haven’t seen this shift in fiscal 2023A, but I believe 2024E will be better.

- Ubisoft has deep war reserves, and I hope the company finally turn around. However, with the renewal of the pipeline and what will happen in fiscal 2023-2024, this will further damage the company’s valuation.

- I’m down 20% and now see the company as a speculative “buy” with 40 EUR PT – that’s all.

Remember, I’m about:

1. Buy undervalued — even if the undervaluation is slight, not mind-numbingly large — companies at a discount, allowing them to normalize over time while reaping capital gains and dividends.

2. If the company is far beyond normalization and into overvaluation, I take the gains and move positions into other undervalued stocks, repeating #1.

3. If the company does not enter overvaluation, but hovers in the range of fair value, or falls back to undervaluation, I will buy more as time permits.

4. I reinvest dividend earnings, savings from work, or other cash inflows specified in #1.

Here are my criteria and how companies meet them (italics).

- The overall quality of this company is good.

- This company is basically safe/conservative and well run.

- The company pays an ample dividend.

- This company is cheap right now.

- The company has realistic upside based on earnings growth or multiple expansions/returns.

I’d call it qualitative, intrinsic, cheap, and good, but I wouldn’t call it well run or paying a dividend. For this reason, I call Ubisoft a “speculative buy.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link