[ad_1]

“Vertiv Holdings Co (NYSE:VRT) is laser-focused on executing well, ensuring we are well positioned to benefit when supply chain conditions improve. Together with E&I, the future of Vertiv has never been brighter and we are excited about the potential value creation opportunities for our shareholders in both the near- and long-term.”- Rob Johnson, CEO

“…our team has thoughtfully followed acquisition best practices during the process of identification, valuation, due diligence and integration planning. E&I represents a unique opportunity for Vertiv and it fits well in the Vertiv portfolio. I am excited about the potential of these two great businesses coming together as one,” – Dave Cote, Executive Chairman

Q3 2022 hedge fund letters, conferences and more

Supercycle Sends Cash Flooding Into Commodity Hedge Fund Strategies

In May 2011, the commodity trading giant Glencore launched its blockbuster IPO, which valued the business at $60 billion. The company hit the market right at the top of the commodity cycle. In the years after, its shares crashed from above 500p to below 100p. The company is the world’s largest commodity trading house. Its Read More

In May 2011, the commodity trading giant Glencore launched its blockbuster IPO, which valued the business at $60 billion. The company hit the market right at the top of the commodity cycle. In the years after, its shares crashed from above 500p to below 100p. The company is the world’s largest commodity trading house. Its Read More

- Rating UNDERPERFORM

- Price (5-December-22): $14.35

- Target price: $2.00

- 52-week price range: $7.76 – $27.97

- Market capitalization: $5.41 B

- Enterprise value: $8.36 B

Legal Disclaimer

After extensive research, we have taken a short position in shares of Vertiv Holdings Co. (NYSE:VRT). This report represents the summation of our opinions.

In no way should this report be taken as investment advice or constitute responsibility for investment gains or losses. The information in this report should not be relied upon for investment decisions. All investors must conduct their own due diligence and consult their own investment advisors in making trading decisions.

Investors seeking investment guidance on VRT should consult resources with professionals licensed to provide investment advice. The investment banks Cowen & Co., Goldman Sachs, Deutsche Bank and JP Morgan are all listed as having securities analysts that cover VRT.

These institutions have significantly greater resources than Dalrymple Finance and the banks’ opinions may differ greatly from ours. We strongly encourage investors to consult these professionals for advice.

This is not a solicitation to transact in any of the securities mentioned.

The data herein has been obtained from public sources we believe to be reliable. However, the information is presented on an ‘as is’ basis and we make no warranty of any kind as to the accuracy, timeliness and/or completeness of any material contained in this opinion piece

Table of Contents

- Déjà vu: E&I Collapse & Aggressive Guidance – Management again misleads investors and faces “unexpected” business collapse

- VRT Modus Operandi: Guide High, Ride Stock, Miss Big

- The Irish Entities Show Collapsed Profitability

- How Much Was Known

- Excessive Valuation – VRT paid at least double the industry multiples for E&I

- Extremely High 30x EBITDA Multiple

- No Fairness Opinion or Financial Statement Disclosures

- Hiding Problems at the Underlying Business

- Accounting & Legal Issues

- Offshore Cash

- History of Guidance and Accounting Issues

- Déjà vu: Another Lawsuit

- Questionable Practices

- The Real Competitive Advantage

- Evidence from South Carolina, Ireland and the UAE

- A Déjà vu Conclusion

Summary

VRT often come with a strong sense of déjà vu, where enthusiasm forecasts of fine performance end in disappointment and poor actual results. Unfortunately, the E&I transaction fits the pattern.

On September 8, 2021, Vertiv announced its intention to acquire E&I Engineering Group, an Ireland-based PDU and busway manufacturer serving data center customers. The company has production bases in Ireland, the United Arab Emirates (since 2007) and South Carolina, US (since 2014).

Total consideration was $1.77B of which $1.16B cash and $600M in shares of the company. On October 27, VRT raised $850M 4.25% 144A notes to fund the transaction, which closed promptly on November 1, 2021.

The incoming “change agent” CEO for VRT Mr. Giordano Albertazzi was head of the company’s EMEA region between 2016 and March 2022. He was likely directly responsible for the segment and due diligence of the major acquisition.

- Knowingly presenting unrealistic financial targets

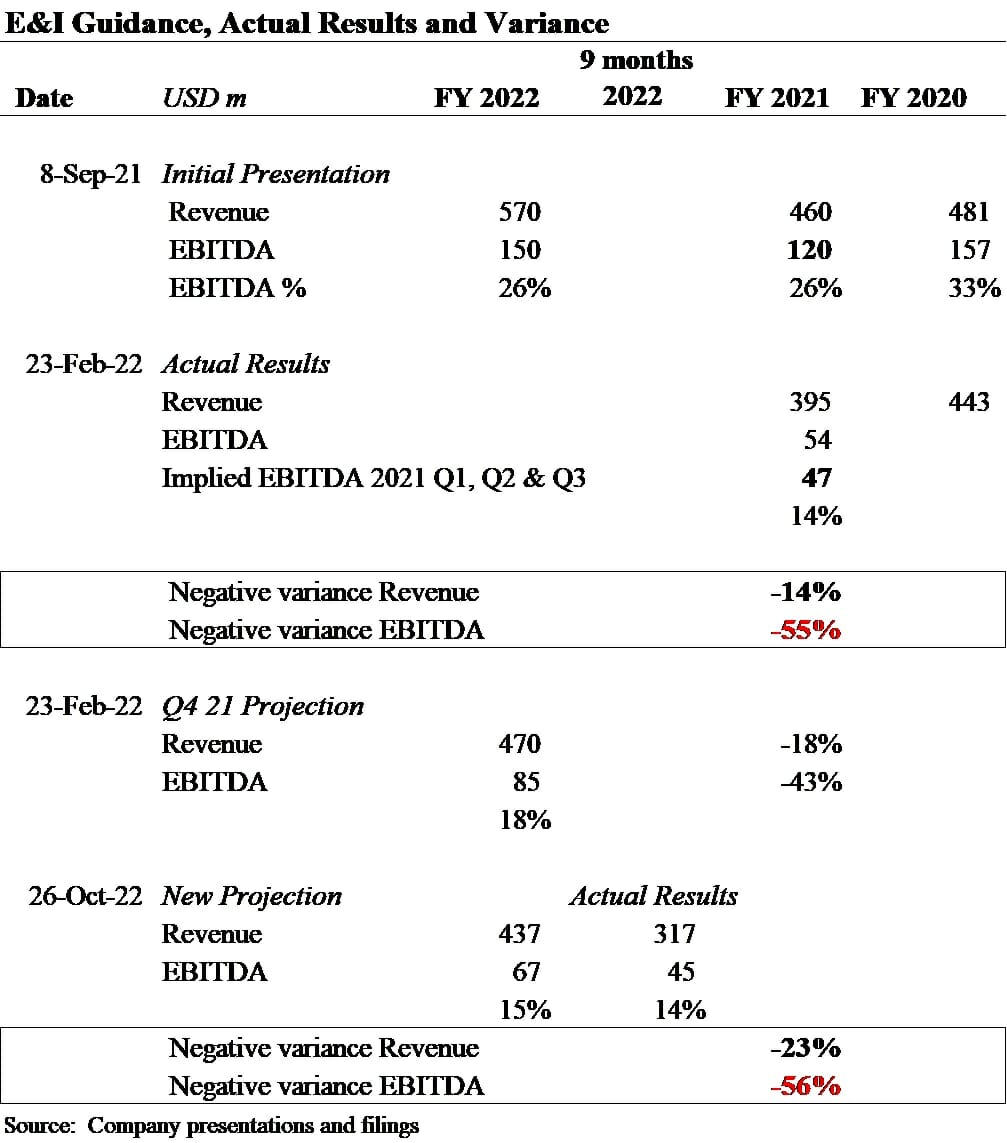

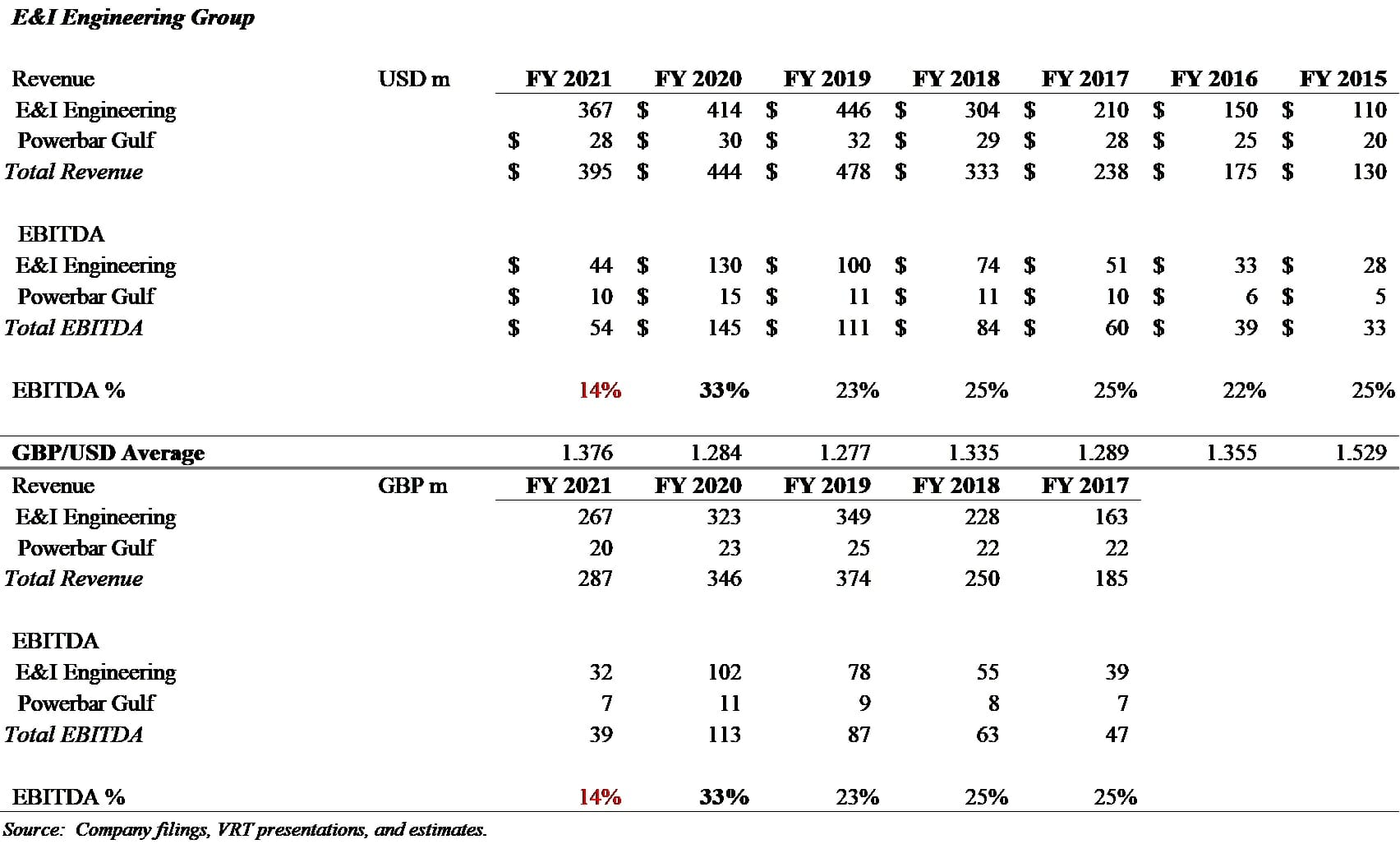

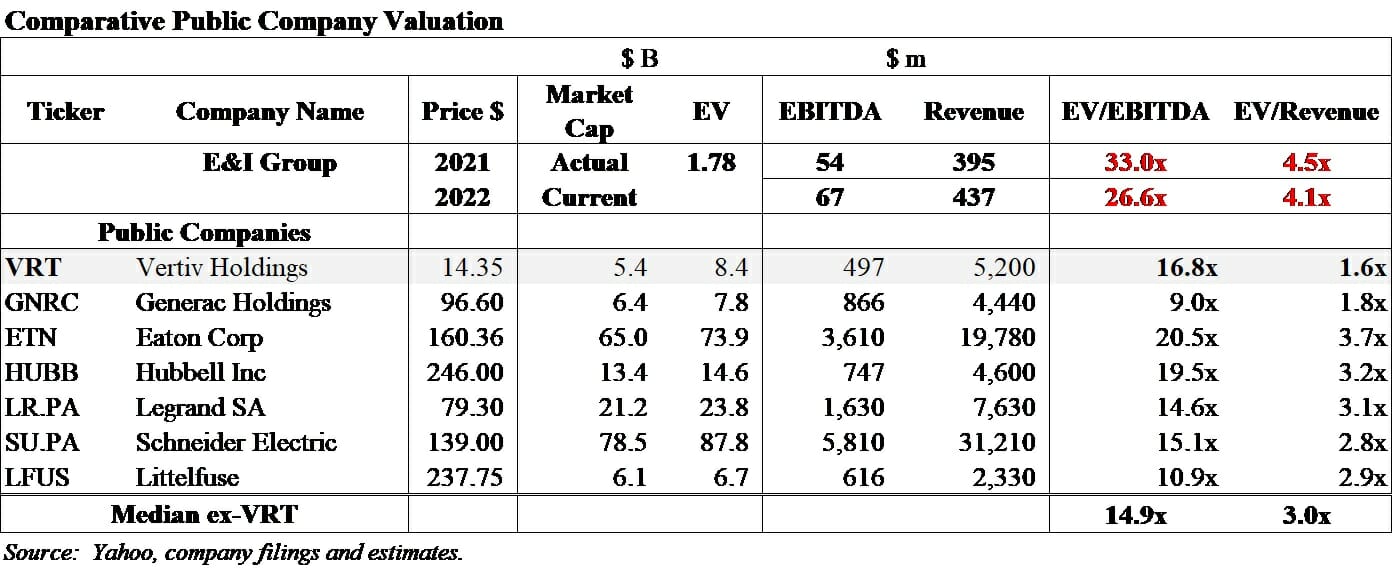

The consideration of $1.8B is 30X the actual 2021/2022 EBITDA and more than double the industry standard multiple. Equally aggressive were the financial targets in the company’s transaction presentation. The table below shows them along with the actual results achieved by E&I since the acquisition:

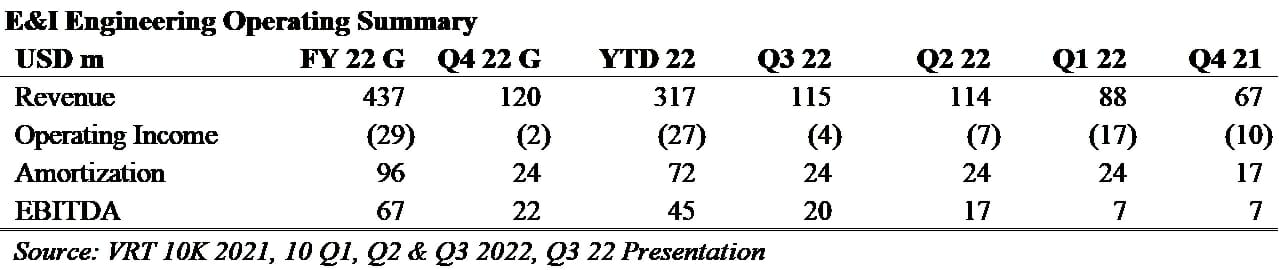

After the transaction close in November 2021 the first reported actual results on Feb 23, 2022 were far below expectations. VRT reported negative operating income from E&I in the quarter and only $7M of EBITDA.

The annualized proforma disclosures in the 10K provide EBITDA of $54M for the year, a staggering 55% miss off the management’s presentation. Given performance at the underlying businesses, management must have known expectations put forth were unobtainable.

- The Irish entities show clear collapse in profitability before the time of purchase

Publicly available financial statements of the Irish subsidiaries show EBITDA margins collapsing.

Audited financial statements show sales declined by -31% and -6% in 2021 at the two main businesses, while EBITDA was off by staggering –63% and -79% even after adjusting it for substantial acquisition costs. None of the statements or historical audited performance was disclosed by management.

Further, VRT’s own 2022 FY guidance is a -56% and -23% negative variance on EBITDA and Sales of E&I from original presentation a little over a year ago.

- VRT overpaid by $1B for E&I and sent the cash offshore

Over 99% of the $1.8B purchase price is allocated to goodwill and intangibles warranting a critical audit note making it is unclear why VRT paid roughly 2x the industry EBITDA and Sales multiples for the collapsing E&I business.

There was no fairness opinion disclosed, and the E&I numbers were excluded from the VRT 2021 audit and most of the cash was sent to a Cyprus entity controlled by Philip O’Doherty, formerly CEO of E&I and now a VRT employee.

The YTD 22 numbers show that VRT needed a European boost to obfuscate some problems in the segment amid booming industry conditions.

- A lawsuit by SAI alleges theft of intellectual property and customers by E&I

According to the lawsuit, E&I won three bids SAI had expected from large customers. The initial revenue was $18.7M with $20-30M of follow-on for a total of $38.7M-$48.7M. We estimate that the $18.7M of revenue associated with the three accounts cited by SAI accounted for ~20% of E&I US sales in 2020.

SAI sent E&I a letter demanding E&I cease (1) interfering with the non-compete agreements; (2) interfering with SAI’s economic opportunities; (3) exploiting SAI’s trade secrets to infringe on SAI’s customer relationships. We contacted SAI, but management declined to comment on the ongoing matter.

- The cheap labor competitive advantage raises serious ESG issues

From allegations of seizing passports in the UAE to an interview with a former South Carolina employee who stated: “Because recruitment and retention were such an issue, even when the felons with sexual convictions were hired, when they repeated these behaviors to others in the workplace they were not fired, they were moved to another area where they had the opportunity to repeat offenses to others. E&I clearly has some HR issues to straighten out.

It makes one wonder where some of that extra $1B went to from the Cyprus account.

Déjà vu: E&I Collapse & Aggressive Guidance – Management Again Misleads Investors And Faces “Unexpected” Business Collapse

Throughout 2021, VRT management assured shareholders higher margins and profitability would arrive by the end of the year. They didn’t. Rather, 4Q21 became known as the ‘big miss’ where promises and guidance were held until the final moment before reported results led to a collapse.

Thus far, 2022 has been similar with the bullish early forecasts fading as actual results bring reality to the fore. The same pattern is evident with the E&I transaction.

VRT Modus Operandi: Guide High, Ride Stock, Miss Big

E&I has followed the data center industry power distribution architecture evolution by adding busway products with better margins (20%+) to the traditional power distribution units (10-15%). It also operates a sheet metal division which provides material to the powerbar and switchgrear manufacturing.

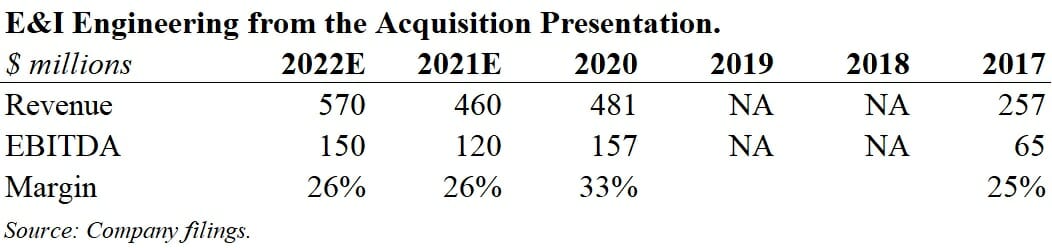

The company was presented to investors as a high-margin, growth business, as is evident in what little management disclosed about the operating history and expectations, which is shown below.

E&I was purchased as a 33% EBITDA margin business in 2020 with $480M in sales, projected to come down on both the revenue and profitability lines to $460M in sales and $120M in EBITDA in 2021 and then stage strong growth to deliver $570M in sales and $150M in EBITDA in 2022, starting short four months away from the time of presentation.

The actual quarterly performance of the business is presented in the table below. Q4 2021 brought only $7M of EBITDA for a total of $54M for 2021 compared to the $120M target presented by management three months beforehand.

Sales targets were off by 15% as well. Given the magnitude of VRT’s overall miss and the granularity of analysis needed to confirm these facts, we believe investors were unaware of it.

The ambitious 2022 guidance is not fairing any better YTD. The initial $570M in projected sales are now guided down to $437M with $317M realized through Q3. More importantly, the 26% projected EBITDA margin, which was touted as a big reason for the “accretive” transaction, is only 14% and $150M of initial projected EBITDA is now expected to come in at $67M with only $45M realized YTD.

These numbers represent a -56% and -23% negative variance on EBITDA and sales of E&I from original presentation a little over a year ago.

The Irish Entities Show Collapsed Profitability

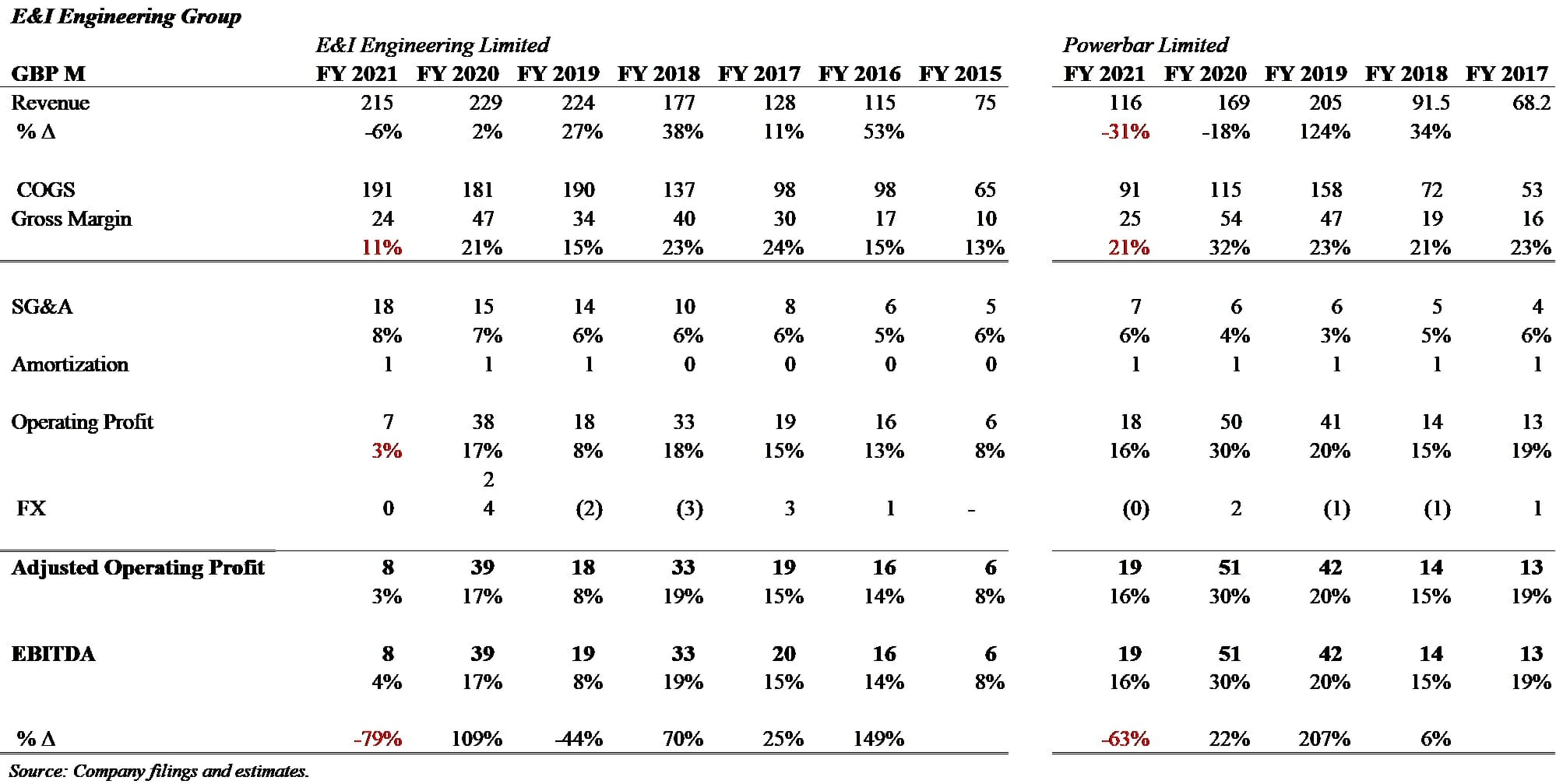

The E&I transaction involved the purchase of two separate entities: 1) E&I Engineering Ireland which includes five entities, two US production and sales and three domiciled in Ireland, the most important of which are E&I Engineering Ltd and Powerbar Ltd and 2) Powergulf LLC, the UAE entity involved in production and sales in the Middle East. The consideration was split 84% to 16% between them.

While we had no access to the UAE company statements, the Irish filings are a matter of public record. We have summarized them in the table below.

The operating companies show demonstrable deterioration of performance off the 2020 highs and peak profitability. Powerbar’s sales declined over 30% in 2021 and EBITDA slipped by 63%. We believe powerbar to be the most profitable business within the E&I Group.

E&I Engineering’s sales were relatively stable YoY 2020/2021 but EBITDA margins collapsed to 4% even after we adjusted for ₤12M of acquisition costs booked in 2021 (we similarly adjusted Powerbar for ₤6M of acquisition costs). Absent the adjustment the E&I Engineering business booked a loss for the year.

Both entities collected a lot of cash in 2021, which was upstreamed as a ₤100M dividend as AR were settled and prepayments decreased signaling weakening order flow. All these developments should have been clearly visible to anyone conducting due diligence on the business.

The consolidating entity E&I Engineering Ireland has transitioned to holding company accounting in 2021 following the change in control. However, there is enough historical information to draw similarly informed conclusions on the direction of the business. The summary financials we constructed are presented below. We have translated them to USD for ease of comparison.

Overall sales of the group ex the UAE business declined by 17% while the EBITDA margin plunged from 31% to 12%. The statements also highlight the abnormal 2020 profitability with margins in the 22%-25% range in the preceding five years. Also of note is the apparent loss of 200 employees from 2019 to 2020 signaling either temping solutions to boost profitability or expected order flow declines.

We have also constructed financial statements of the consolidated group including Powerbar Gulf, the UAE entity, using historical data and publicly available information in the table below. While the numbers have an element of estimate, they do conform to the publicly disclosed financial performance of the business.

Again, there is a clear collapse in the performance of the combined entities with EBITDA margin halving YoY. Given the exceptional nature of the FY 2020 margin of 33% a return to the historical norm would have been likely. However, profitability appears to have been pulled forward preventing margins from recovering to historical levels in 2022.

The financial patterns evident on the combined statements suggest eroding results must have been expected at the time of purchase. We believe this is evident in how management comments on questions relating to the E&I’s sub-par performance.

On VRT’s 3Q22 conference call an analyst noted that E&I had contributed EPS of $0.02 vs $0.10 at the time of the transaction and asked if something had fundamentally changed? The question was not answered directly.

Rather than explaining why E&I was seemingly producing at only 20% of its previously stated run-rate and sales would miss by $130M, the question was avoided. CFO Dave Fallon said “part of the value was based on synergies. And our expectations are probably 3x or more of what we originally anticipated.

Unfortunately, that’s not showing up in the numbers this year.” The newly appointed CEO, former EMEA manager Giordano Albertazzi, echoed Mr. Fallon adding “I think it strategically made sense, and all the more reason it makes a ton of sense, a ton of sense now.”

Neither Mr. Fallon nor Mr. Albertazzi’s answers were forthright. Rather than provide an explanation as to why E&I was underperforming to such a magnitude, they simply doubled-down on the future.

In what has become a well-established, identifiable pattern of behavior, management supplants either delivering on expectations or frank explanations of variance with grandiose pronouncements.

How Much Was Known

Data from the public documents show that E&I’s problems were partially or completely known to users of original financial statements. Further, in its 10K 2021 filing, VRT’s own numbers confirm that the company knew that the business has only generated $47M in EBITDA in the year of acquisition up to transaction close.

The number is based on the proforma disclosures which contain adjustments to “proforma events that are directly attributable to the transaction, factually supportable and expected to have a continuing impact on the combined results.”

The purchase and sale agreement filed with the SEC, defines Management Accounts as “accounts of the E&I Group and Powerbar Gulf, comprising the unaudited aggregated balance sheet … profit and loss accounts … for each of the monthly periods from the Last Accounts Date (Dec 31, 2020) to March 31, 2021 inclusive.”VRT was given 40 days to file any disagreements with the Completion Accounts prepared as of June 30, 2021.

Additionally, there is a pre-completion provision requiring the Sellers to “as soon as reasonably practicable, give to the Buyers reasonable details of any material change in its business, financial position or assets”

Despite the factually supportable results, management still chose to not discuss its $120M guidance for the year ending two months prior.

Unlike the factually supportable low EBITDA numbers, VRT has avoided putting forward any audited information and has tried to disclaim the high guidance numbers as much as possible. For example, in an 8K filing dated October 13, 2021 as part of raising $850M 4.25% Notes for the transaction the company noted:

“While Vertiv has reviewed the unaudited historical data related to E&I provided by E&I in the course of Vertiv’s due diligence, it has not independently verified such data.

In addition, this information has not been audited, reviewed, examined, compiled or verified by any independent auditor and has not been prepared in accordance with generally accepted accounting principles in the United States. The forecasts in the acquisition presentation are similarly disclaimed.

Further, although a transaction that represented 28.7% of VRT assets at FY end 2021, E&I was excluded from the company’s audit opinion. “management’s assessment of and conclusion on the effectiveness of internal control over financial reporting did not include the internal controls of E&I. Given the nature of the assets, the exclusion could represent a material risk.

Over 99% of the E&I transaction net consideration of $1.765M is allocated to Other Intangible Assets $1B of which customer relationships is $731M and Goodwill of $748M. As we detail later in the report, there is a lawsuit against E&I for fraudulently acquiring customers.

Not surprisingly, the valuation of these intangible assets valuation warranted a special mention by E&Y in the audit as a critical audit matter. “The significant assumptions used to estimate the fair value of customer relationships included the forecasted earnings before interest, taxes, and amortization, customer attrition rates and a discount rate.

The significant assumptions used to estimate the fair value of developed technology included the forecasted revenue, royalty rates and a discount rate. These significant assumptions are forward looking and as such inherently uncertain.”

If the valuation was based, in part, on the original $150M 2022 EBITDA estimates management provided to investors, there should be an impairment logged at year end.

99% of the large $1.8B purchase price allocated to two intangibles raises questions about the nature of the valuation. It is a pattern more reminiscent of technology company rather than a switchgear and powerbar manufacturer.

Excessive Valuation – VRT paid at least double industry multiples for E&I

Extremely High 30x EBITDA Multiple

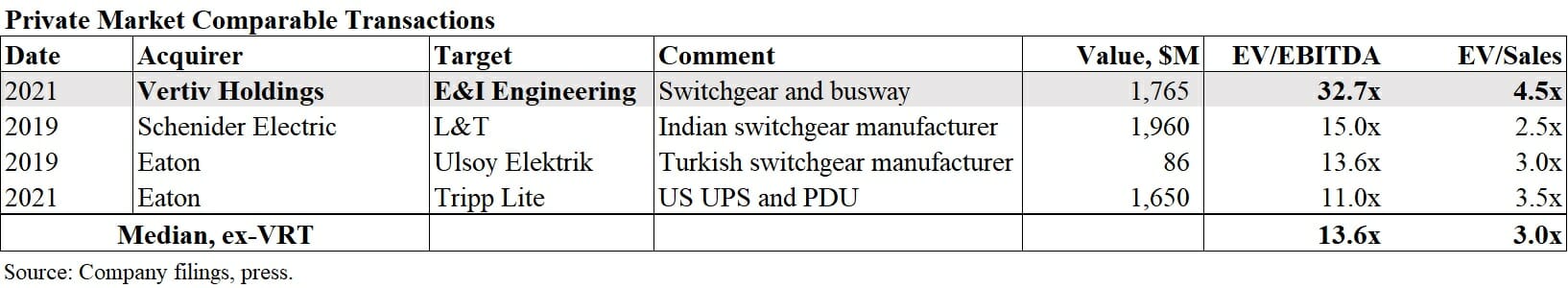

VRT paid a staggering ~30x EBITDA 2021 or 2022 for the E&I business and over 4x revenue. These valuation metrics are at least double the industry standard for much better capitalized and diversified public companies as shown below.

Public companies average 15x EV/EBITDA with a range of 10-20x. EV/sales multiples are tighter, around 3x. E&I’s transaction multiple on 2021 took place far above any publicly traded comparable. In 2016, Platinum purchased the debt-free VRT for $4B at an EV/sales of ~1x and ~7x EBITDA.

The deal is even more overvalued relative to private transactions. Over the last several years, M&A transactions in VRT’s industrial space have typically taken place at EV/EBITDA multiples of 11-13x and ~2-3x sales.

The table below shows several recent acquisitions to provide context.

Schneider paid 15x for a high-end Indian switchgear manufacturer with other more representative transactions at 11 to 13x. Further, both the Indian and Turkish deals come with a low-cost manufacturing bases in reliable jurisdictions and sales concentration in the local market – 60% in the case of Ulsoy Turkey – which creates strong international growth prospects under the umbrella of the larger organizations.

In 2019 Legrand acquired Universal Electric Corporation with its line of Starline busways for power distribution. Starline is considered to be the top in the business and competes with E&I’s power bar products.

Although valuation data on the transaction was not disclosed, we know the company generated $175M in sales in the year acquired. Assuming a margin comparable to E&I’s Powerbar of 22% and an industry multiple of 12x EBITDA, we estimate it was purchased for ~$460M.

Legrand’s financial statements for 2019 note that the company made three acquisitions that year with Starline being the largest. Reported acquisitions’ net cash outflow was EUR 452.7M or $507M at the average exchange rate for the year. We believe our estimate is corroborated by the audited data.

At the time VRT purchased E&I, we estimate it was worth $700-800M at the top end. An EV/EBITDA multiple of 12x on 2021’s $54M of EBITDA yield a $650M value. The same multiple on 2022E EBITDA of $67M yields a value of $804M. Blending the values obtained from industry normalized multiples shows E&I was worth ~$726M. At $1.76B, VRT paid roughly 2.4x the valuation overpaying by a total of $1B.

Press reports support our thesis that VRT vastly overpaid for E&I. In 2019 it appears Mr. O’Doherty began signaling that E&I was for sale. There were two pieces in the press at the time that discussed the profitability of the enterprise.

A November 2019 article in the Sunday Times was particularly glowing, noting that revenues and profits surged in 2018, making it one of the most profitable companies in the country. It cited ‘industry sources’ valuing the company at approximately GBP 500M, a multiple of ~10x operating income, which equates to a price of ~$640M.

VRT paid 2.76x what E&I was estimated to be worth, and presumably Mr. O’Doherty thought fair, only two years prior on lower income.

The context of both industry multiples and a relatively recent valuation ‘signal’ to potential acquirers begs the question: why did VRT pay nearly $2B for this company when it was clearly worth less than ~50% of the price?

No Fairness Opinion or Financial Statement Disclosures

VRT did not publish detailed financial statements on E&I, despite the fact that they are available. Given the excess valuation paid in the face of a company past peak profitability with declining sales, we have to question VRT’s board’s due diligence efforts in contrast to Mr. Cote’s statement.

As a $1.77B transaction that increased VRT’s net debt by ~33%, the E&I deal has had a material financial impact on the company. We assume that the board, at minimum, obtained one fairness opinion – often two are commissioned. The fairness opinion would include financial information and comparable valuation data that would provide some context and justification for the purchase.

To our knowledge, a fairness opinion on E&I, assuming one exists, has not been made public or even referenced in public filings.

We strongly encourage management to publish all fairness opinions obtained prior to the transaction. In our view, publication could help resolve a number of the many questions arising from the financial anomalies and excessive valuation associated with the transaction.

Hiding Problems at the Underlying Business

Giordano Albertazzi, currently COO and President of the Americas is set to become the CEO of VRT in January 2023 when Robert Johnson steps down. Previously to assuming his current post in October 2022, Mr. Albertazzi was President of the company in Europe. We believe that in the capacity of President, Mr. Albertazzi would have been instrumental in bringing the E&I acquisition to Vertiv.

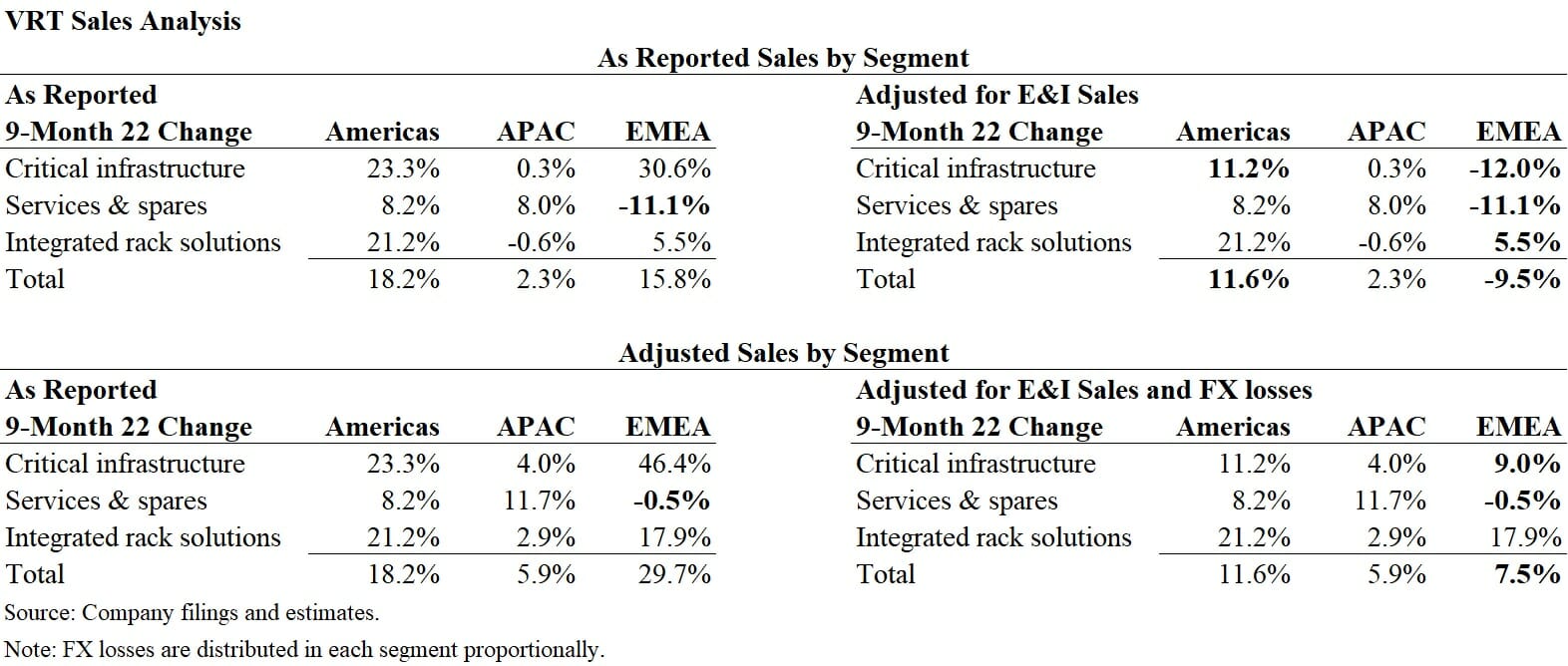

Analysis of sales as reported and adjusted for E&I’s contribution shows Mr. Albertazzi’s legacy to be the largest beneficiary of the transaction. On an as reported basis, EMEA is a growth market, but excluding E&I sales shows significant erosion of sales throughout 2022.

We disaggregated E&I sales from the combined results to show the organic change in VRT’s business. In the table below we compare sales in two ways. We show total sales for all segments for the 9-month periods of 2022. The panels on the left show sales as reported, on the right, we remove E&I’s contribution to show VRT’s organic change in sales.

In the bottom part of the exhibit, we show the same 9-month changes, but with both panels adjusted for the FX losses in the period. The right panel also has E&I removed.

All E&I sales are recorded in the Critical Infrastructure segment. We have highlighted the appropriate numbers to show the impact of the adjustment.

The comparison highlights two issues. On an as reported basis, Europe shows respectable 15.8% growth overall, with 30% growth in Critical Infrastructure, where E&I sales are recorded. The top right panel adjusted for E&I shows an overall decline of 9.5%, indicating results in the segment would have been deeply negative without the acquisition. Critical Infrastructure, the largest segment, would have been down 12%.

The bottom panels show sales adjusted for FX losses. Excluding E&I sales but adjusted for FX losses shows below-industry growth of 7.5% down from proforma +30%. The Services segment is particularly weak; and although growth is strong with Integrated rack solutions, the division is very small.

The lack of growth in Europe is particularly disconcerting because competitors have noted the strength of markets thus far in 2022. Schneider Electric noted on its conference call that its data center business was experiencing ‘double-digit’ growth on a y/y basis.

Western Europe was up 14% on an organic basis. Eaton noted “solid growth in Europe”. Similarly, Legrand reported that the data center business was up despite difficult y/y comparisons and Europe; business was up 10.5%.

VRT’s European business is weak and without the acquisition would have shown -9.5% revenue decline while the industry was recording 10%+ results. We suspect that Mr. Albertazzi and VRT management were aware of the European trends when the purchase E&I was proposed. Although E&I has dramatically underperformed expectations, it has effectively masked weakness in the company’s European business.

Legal and Accounting Issues

Déjà vu – Another lawsuit

Lawsuits are an important feature of VRT’s history and operations. Our first report on the company relied heavily on lawsuit testimony from executives indicating that management lied to investors throughout 2021 in effort to inflate the stock price.

Prior to the current class action, the company was sued in conjunction with Facebook for stealing the intellectual property regarding warehouse sized pre-fabricated, modular designed data centers of the Bladeroom Group. Litigation began prior to Platinum’s acquisition of VRT. A $120M judgement (indemnified by Emerson) against VRT was recently vacated and the matter is ongoing.

As part of E&I’s acquisition, VRT must contend with a multi-faceted lawsuit alleging theft of intellectual property, trade secrets and customers.

E&I was sued in March 2021 in US District Court in Illinois by a Chicago-based competitor, SAI Advanced Power Solutions (SAI). In the second amended complaint filed on 12/21/21, SAI makes several allegations centered around the activities of VP of Sales, Shane Wolfram, who left SAI to work for E&I.

The lawsuit states that at the time just prior to VRT’s acquisition of E&I, the company was retooling its US switchgear business, incorporating SAI technology and confidential information on what wins bids and targeting a number of SAI’s large clients with some success with the help of Mr. Wolfram. The plaintiff alleges E&I fraudulently acquired some switchgear technology and customers.

SAI alleges that the former employee, in violation with his non-compete and separation agreement, worked with E&I to co-opt SAI technology and ‘pilfer’ top-10 customers. Customers on the non-solicitation list include large hyperscale developers and operators, such as CloudHQ, Stack Infrastructure, Iron Mountain and Toshiba. E&I won contracts with CloudHQ and Stack Infrastructure following the hiring of Mr. Wolfram.

The suit alleges collusion between Wolfram and E&I and CEO O’Doherty. SAI supports its claims with telephone records, emails and texts likely obtained in discovery. The suit notes that Mr. Wolfram deleted 200 text messages to E&I representatives before turning in his company phone to SAI.

The suit details an incident where Mr. O’Doherty, unaware that Mr. Wolfram has turned his corporate phone in to SAI, calls and immediately begins discussing how to recruit another SAI employee to E&I – a prohibited action under Wolfram’s agreement with SAI. Mr. O’Doherty was unaware that it was not Mr. Wolfram who answered, but a loyal SAI employee. The conversation was subsequently reported to SAI management.

The matter is ongoing but the case should be concerning to VRT. It is a lawsuit management must have encountered during due diligence, and did not disclose to investors. More importantly, it appears VRT did not have the matter indemnified in the purchase and sales agreement.

The purchase and sales agreement specifically cites an ongoing matter related to an insurance claim, but states that “no group company is the subject of any legal or regulatory investigation, inquiry or audit, in each case, in respect of which the liability of the Group is likely to be in excess of $1,000,000 individually.”

Although the Bladeroom action has reverted back to the starting position, the original $120M liability is suggestive of the scale of awards. The E&I lawsuit suggests there was $39-49M in sales directly attributable to three customers ‘pilfered’ from SAI. A loss in court would mean that VRT purchased an under-performing company at a sky-high valuation that included a significant legal liability.

$731M or 40% of the purchase price of E&I was allocated to “customer relationships”. Perhaps the lawsuit’s allegations that some customers were fraudulently obtained was the impetus for E&Y tagging the intangible with a critical audit matter.

History of Guidance and Accounting Issues

VRT has a history of guidance and accounting issues in its short history of an independent public company since February 2020.

First, on March 1, 2021 E&Y gave its 2020 audit a qualified opinion on account of deficient controls over financial reporting.

“In our opinion, because of the effect of the material weaknesses described below on the achievement of the objectives of the control criteria, the Company has not maintained effective internal control over financial reporting as of December 31, 2020, based on the COSO criteria.

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis.

The following material weaknesses have been identified and included in management’s assessment. Management has identified material weaknesses in controls related to

(a) not fully designing, implementing and monitoring general information technology controls in the areas of user access and program change-management for systems supporting all of the Company’s internal control processes;

(b) the aggregation of open control deficiencies across the Company’s financial reporting processes because the controls were not fully designed and operating effectively.”

Secondly, on February 23, 2022 after repeatedly guiding revenue and AOP expectations higher, VRT missed its own months old guidance by an exceptionally large margin of 80% on the profitability metric of adjusted operating income sending the stock down 37% on the day of the reporting.

A number of shareholder lawsuits ensued and at least one appears to be settled. However, on September 16, 2022 an amended suit was filed for the City of Riviera Beach General Employees Retirement System v Vertiv Holdings Co. Et al, case number 1:22-cv-3572.

It provides testimony from high level VRT employees that management deliberately mislead investors about the nature and prospects of the business in order to help effect sales of shares for the private equity owner at inflated prices. Here is a link to the amended complaint.

VRT has not publicly commented on the allegations and its defense strategy and none of the sell side analysts mention its existence or relevance to the company.

Offshore Cash

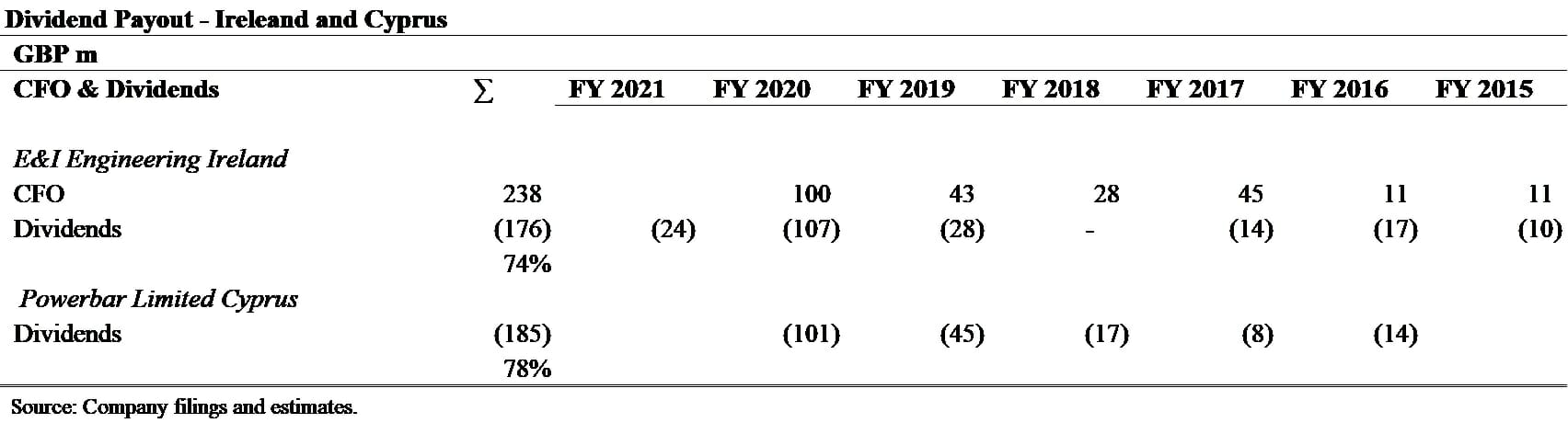

In addition to collapsing profitability and excess valuation, the E&I Group has been stripped out of cash on a regular basis via its controlling shareholder Cyprus offshore entity Powerbar Limited Cyprus which holds controlling share of the two underlying companies. The table below summarized the data from Irish & Cypriot disclosures:

dsadas

More than 2/3 of all the cash generated by the E&I group has been paid out via the entity. Further, the cash and share consideration of $1.8B paid by VRT was very likely received by the same entity and distributed offshore. None of this was disclosed and Philip O’Doherty, the CEO of E&I and controlling party of the Cypriot firm is a VRT employee.

Questionable Practices

The Real Competitive Advantage

E&I does not hold a technological, distribution or other advantage in the commoditized business of PDU and powerbars. In fact, the company faces stiff competition from large and well-established and better-capitalized entities.

The only real advantage (other than customer poaching discussed previously) is ability to access cheap labor in relative proximity to its end markets in order to keep transportation costs low.

However, there is an issue with how E&I is able to achieve its competitive edge which impacts its sustainability.

Evidence from South Carolina, Ireland and the Persian Gulf

There are consistent themes with employee reviews across E&I’s three manufacturing locations. They center around low pay, high turnover, few opportunities for advancement unless a ‘friend of management’, favoritism displayed by management, an unprofessional ‘manage by fear’ style.

There are distinctions among them. Reviews indicate Powerbar Gulf in the UAE is the most troubling work environment. They site behavior that goes beyond the overwork, bad management and poor conditions cited at other facilities, and include harassing and threatening behavior by managers, financial penalties and threats, and passport seizure, which would make a worker more akin to a slave.

South Carolina’s complaints are just behind the UAE, centering on what should be unacceptable behavior, including tolerating serial sexual harassment offences from felons.

E&I Engineering U.S. and Ireland

E&I Glassdoor reviews in the U.S. show 7 1 and 2 star reviews and 5 4 and 5 star reviews. E&I Ireland and the U.S. has 13 5-star reviews and 9 1-star reviews. However, all 9 1-star reviews were marked as helpful by one or more individuals; only 1 of the 13 5-star reviews received a helpful vote.

E&I’s South Carolina facility has a deeply troubling reputation. There are a number of reviews on Glassdoor. However, a quoted text from a conversation with an employee provides details of what appears to be a significant, ongoing corporate problem.

The text below are unedited outtakes from our conversation:

“The overall morale at the plant is extremely poor, many folks feel they’re underpaid, overworked and underappreciated. I found the staff, both in US and Ireland, to make a lot of promises and pledges and frequently not uphold them. Annual reviews were not conducted in a timely manner, raises and bonuses were not implemented when promised either.”

“Americans at the factory believe they cannot be promoted unless they’re Irish and this resulted in a lot of turnover. Devices, equipment and products frequently left the plant with significant issues and possible hazards and dangers. The production workers were being led by unqualified individuals.

Many of the workers and staff had significant criminal records, convictions of sexual offenses were common for hires. Because recruitment and retention were such an issue, even when the felons with sexual convictions were hired, when they repeated these behaviors to others in the workplace they were not fired, they were moved to another area where they had the opportunity to repeat offenses to others.”

“The Anderson, SC facility is a disaster and I fully anticipate future lawsuits and issues to plague the company until significant changes are implemented…”

1.0 ★★★★★ Current Employee

Jun 10, 2021 – Accounts Assistant in Burnfoot

Pros

It’s easy to get a job here due to the high turnover

Cons

Staff are discouraged from talking even about work so the atmosphere is horrible. Pay is low for most and there is no real payscale and major inconsistencies. Employees are discouraged from discussing their pay. The atmosphere is horrible as everyone fears management.

They do nothing to benefit the lives of employees, no clubs, no events, not even a canteen on site. Management use punishment rather than praise to “motivate” staff. Bullying by management is common. Innovation is discouraged Staff are generally unhappy and this unhappiness is contagious.

If you are on a salary, expect to do a lot of unpaid overtime. Staff are not valued. They would rather replace you than give you any kind of pay increase. There is more staff than there is parking. Staff turnover is high so it can be hard to know who’s doing what.

Advice to Management

Place more value in staff. Do more to support staff. Encourage innovation. Listen to staff and their needs.

Powerbar Gulf Reviews

We have included several employee reviews on Powerbar Gulf from two sites below. To put the reviews in context, both groups are rated from 1 to 5 stars. Indeed.com had only 15 reviews, roughly evenly split between 1 and 5 star with approximately 18% for each group.

Google has 75 reviews, split almost 50/50 between 1 and 5 star. However, Google provides a ‘thumbs up’ option if readers find the reviews helpful. The more detailed 1-star reviews showed below were voted most helpful, suggesting that the reviews resonated with readers.

Sachin Prajapati – 2 reviews – 7 months ago – 1/5★

Worst company do not deserve even a single star. First of all, The whole recruiting and staffing procedures are horrible. Moreover, once you board, they started treating inhumanely with you. Even they don’t have felicitous amenities for their employees and doesn’t wants to ameliorate either.

In case, you want to leave or deny to work, they charges enormous penalties and cease passport too. As a result, you found yourself in big trouble. What ever I have written here, is from the worst experienced had by my one of the friends so, i thought to narrate it with you, in hope to depicts real picture of this firm before to opt. Lastly, it might be the best for some other guy, but it was scarred stiff for my friend.

Miyatra Dolly – 2 reviews – 7 months ago – 1/5★

Zero star ⭐ One of the worst HR team. If you want to left the company, then they will terrorize you and will tell you that you will be not able to work in gulf if you left our company. They will be polite on mail but in actual they will insult and scarify you in personal.

U will have to work under a revenging GM, management is very much incapable to handle employees. You will feel like in a jail under jail warden . People get runaway from the company or will be terminated with silly reasons

Déjà vu Conclusion

VRT is a chronic underperformer having missed every material financial goal set, yet management’s forward-looking statements are replete with grandiose expectations. Even what should be mundane 8-K on bonus compensation filed on November 21, 2022 attempted to strike an inspirational tone of hope for the future finances of the company.

The board set performance compensation levels at $1B on AOP, 35% above what we believe is already an unobtainable $740M. The 8-K states that the board believes it’s a stretch. It’s not. It’s ridiculous. Part of a much larger pattern of behavior where facts and reality are eschewed in favor of great proclamations signaling a profitable future.

Less than 3-years into its life as a public company, the rhyming pattern is evident in VRT’s failures. Promised margins fail to materialize, bullish guidance is lowered and missed, and the high growth and profit expectations of the acquisition target disappear as results shift from estimated to actual.

Over time these series of failures evoke a sense of déjà vu. Evidence in the lawsuit suggests that investors and analysts were being misled regarding various aspects of the business, including the likelihood of financial performance.

Our research and analysis of E&I’s financial statements indicate that management and the board must have known that the company would not meet near-term projections. There is what is becoming a firmly established pattern of intent.

There is a playbook in the pattern and management appears to stick to it. And why wouldn’t they? Every time management offers up a new higher financial target analysts seems to forget the immediate recent past and help support the stock.

The problem is that the great expectations put forth to investors by management are not factually supported, but at best hopes and dreams, at worse intentional distractions.

Our analysis is factually supported. E&I financial statements show that the company was destined to miss management’s guidance. The transaction provided a great hope during a trying time for shareholders, but as befitting with VRT’s history, it too is a disappointment – except to the sellers.

[ad_2]

Source link